Agency Banking: Card-less and Card-based

(Micro “Human” ATM) ~ Future of Branchless Bank!

The world is shifting its focus from traditional brick and mortar structures to “branchless” banking via agents, with mobile banking services now becoming the new frontier for product innovation and channel delivery.

Agent Banking delivers banking services to door-step of the marginalized and unbanked customers, who, for many years have not been able to travel long distances to do banking.

Main Objectives of Agent Banking are:

- To fulfill the constitutional rights of the unbanked masses who are also entitled to access to financial services

- To leverage distribution channels and make the Bank more accessible to its customers

- To provide low cost banking services to the poor who cannot afford to travel long distances to carry out banking transactions.

Estel‘s innovative Agency Banking solution enables Bank to go Branchless & increase reach & accessibility of their services & reduce Capex Costs. This technology is expected to revolutionize Branchless Banking & bank services usage in developing economies.

Estel‘s innovative cardless Agency Banking solution enables Banks to go Branchless & increase reach & accessibility & reduce Capex Cost. This technology is expected to revolutionize Branchless Banking & usage in developing economies.

The solution enables banks to:

- Enroll a large network of agents (usually in a hierarchical network)

- Provide them with float / liquidity (usually prepaid, in a wallet held in Estel platform)

- Enable agents to open bank accounts for customers

- Enable agents to use the float in their wallets to do cash-in & cash-out for bank customers

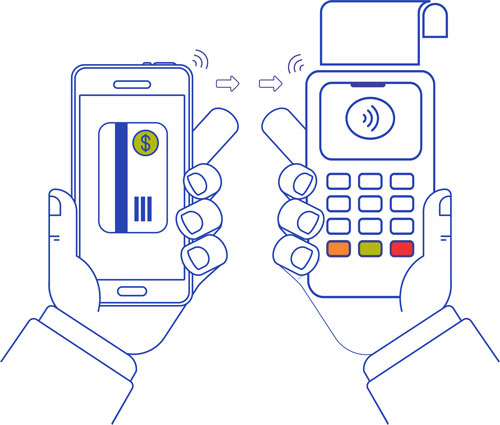

How it works?

- Bank ‘trusted’ Agent is appointed ‘ Banking Agent’, equipped with Mobile & POS system

- Agent helps Customer to open Bank Account at their door Step by collecting the necessary KYC documents as per regulations so that Customer can utilize banking services without going to a Branch

- Customers can easily use authorized Agents to avail Services of Cash in, Cash out, Domestic Money Transfer securely through SMS or OTP

- Agency Banking enhances the abilities of Banks to acquire more Customers, and serve existing customers better & with lower costs, thereby contributing positively & directly to a Bank’s Balance sheet

Supported Use cases:

- Account Opening

- Cash Deposit

- Cash Withdrawal

- Balance Check

- Mini Statement

- Prepaid Recharge

- Bill Payments

Estel Micro “Human” ATM is an innovative, mobile based ultra-low cost ATM, which is operated in agent assisted mode. The solution enables banks to appoint and manage agents, who function as ‘Human ATMs’, to provide following services to bank customers, on their ATM/Debit card:

- Cash Deposit

- Cash Withdrawal (cash out from bank account)

- Balance Check

- Mini Statement

- Prepaid Recharge

- Bill Payments

Beginning 1969 when ATMs were first introduced, they have evolved into high tech, very secure, full-fledged, feature rich banking terminals, offering convenient services to customers, and reducing costs for banks.

ATMs are now spread globally, and available in most urban areas, even in emerging economies. Emerging markets face unique challenges in ATM deployment, making their rollouts slow:

- High real estate & support infrastructure costs & bottlenecks

- High operating costs (cash replenishment, security, rent, power, communications)

In emerging markets ATMs are mostly used for Cash Deposit, Cash Withdrawal, Balance Check, Mini Statements & Bill Payments, with cash withdrawal being the primary use case for most customers.

has created Mobile based innovative technology, which enables ultra-low cost ATM capability, operated in agent assisted mode, as Human ATM (also known as Micro ATM)

This Micro ATM technology is expected to revolutionize ATM rollout s & usage in emerging economies.

p>Read More: Micro ATM Case Study